C1

How to use:

You have two different expenses to record here but be careful because one of them is an operating expense and the other is an equipment expense so they are recorded differently. The $5000 is recorded as an addition to the normal 3% you are already paying in Other Expenses on the P&L. You are spending $8,500 on equipment but be careful not to make the mistake of recording this as an “Other Expense” on the P&L. Remember that you are purchasing equipment which is an asset that the company will then own so we need to record it differently than a common expense. Here is how you record it. You are going to make a positive entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking credit for the new asset that you just purchased. Next, you are going to make a negative entry on the Statement of Cash Flows under the Investment Activities section for Paid Out Purchase of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month.

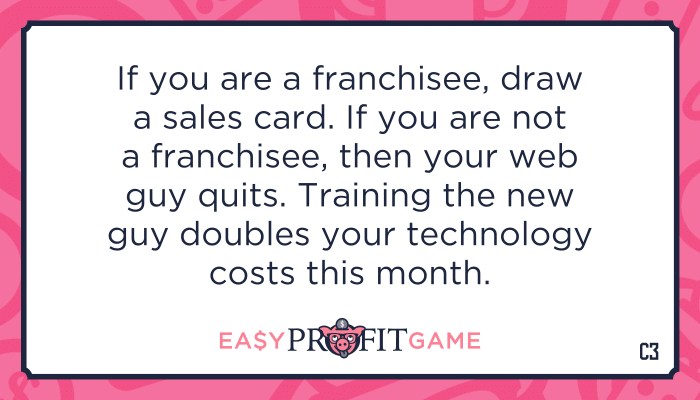

C3

How to use:

Well, if you are a franchisee then you likely do not even see Technology Systems on your P&L because your franchisor has it on theirs! Congratulations. You may contribute to the technology fee but at least you do not have to deal with these kind of issues. If you are not a franchisee then your costs for Technology Systems expenses doubles on the P&L under expenses.

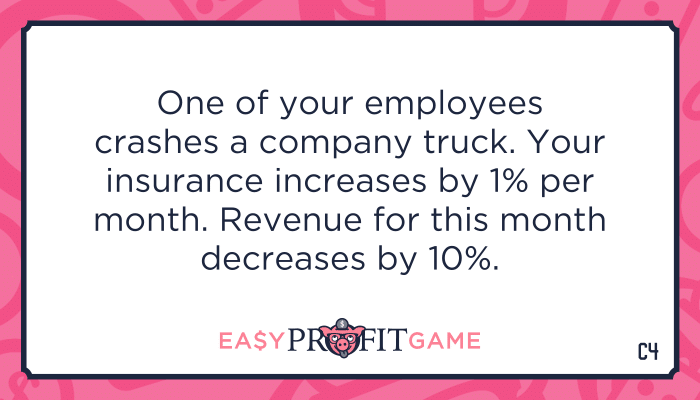

C4

How to use:

Thankfully, your insurance covered the cost of the truck repairs but your insurance rates increase by 1% from what they are currently and that change sticks for future months so go ahead and cross out the 1% (or current) shown on the P&L and take it up by 1%. You also take a hit on your revenue by losing 10% for this month only. Record this as a negative number in the Other Revenue section so you will subtract this amount as you calculate the Total Income for the month.

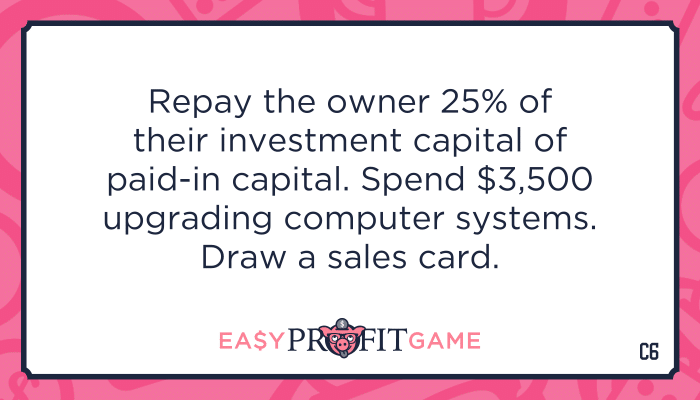

C6

How to use:

Ok, this sounds more complicated to record than it actually is. Let’s tackle the repayment of investment capital to the owner. Calculate what 25% of their paid in capital is to start with. You can find the amount of paid in capital in the month of January under Financial Activities on the Statement of Cash Flows or under Owners Equity on the Balance Sheet (unless part of it has been paid back previously). To record the 25% pay out, find Repayment of Paid in Capital under Financial Activities on the Statement of Cash Flows. You will record the 25% paid out amount as a negative number during the current month only on the Statement of Cash Flows. This entry will reduce the Cash at the Bank for the following month. You also need to reflect the reduction of Owners Equity on the Balance Sheet on the Capital line. This entry records the fact that the company now owes the owner less than previous. You are also spending $3,500 on equipment but be careful not to make the mistake of recording this as an “Other Expense” on the P&L. Remember that you are purchasing equipment which is an asset that the company will then own so we need to record it differently than a common expense. Here is how you record it. You are going to make a positive entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking credit for the new asset that you just purchased. Next, you are going to make a negative entry on the Statement of Cash Flows under the Investment Activities section for Paid Out Purchase of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month. Finally, do not forget to draw a sales card before you complete your calculations for income this month.

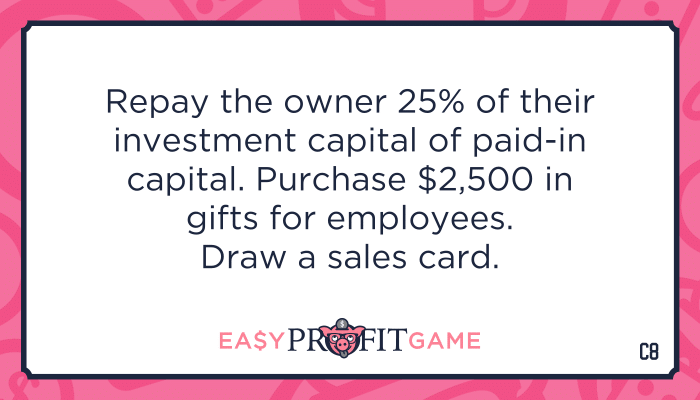

C8

How to use:

Ok, this sounds more complicated to record than it actually is. Let’s tackle the repayment of investment capital to the owner. Calculate what 25% of their paid in capital is to start with. You can find the amount of paid in capital in the month of January under Financial Activities on the Statement of Cash Flows or under Owners Equity on the Balance Sheet (unless part of it has been paid back previously). To record the 25% pay out, find Repayment of Paid in Capital under Financial Activities on the Statement of Cash Flows. You will record the 25% paid out amount as a negative number during the current month only on the Statement of Cash Flows. This entry will reduce the Cash at the Bank for the following month. You also need to reflect the reduction of Owners Equity on the Balance Sheet on the Capital line. This entry records the fact that the company now owes the owner less than previous. You are also spending $2,500 as a general expense to support your team so that will be recorded as an Other Expense on the P&L Finally, do not forget to draw a sales card before you complete your calculations for income this month.

C9

How to use:

You are selling $5,500 worth of old equipment but be careful not to make the mistake of recording this as Income on the P&L. Remember that you are selling equipment which is an asset that the company so you need to enter that differently than general income. Here is how you record it. You are going to make a negative entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking voiding the value of the past asset that you no longer own. Next, you are going to make a positive entry on the Statement of Cash Flows under the Investment Activities section for Paid In Sale of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month.

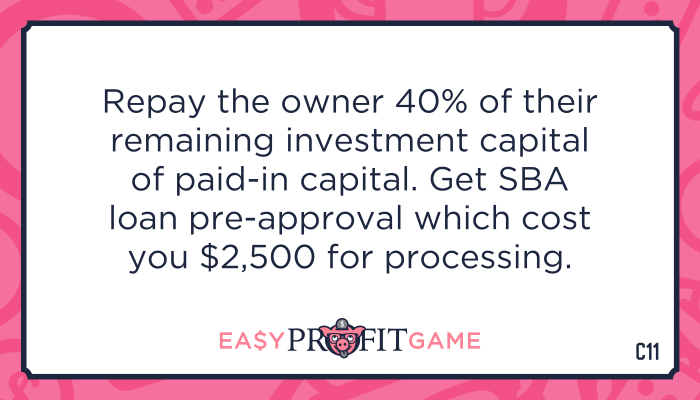

C11

How to use:

To calculated the repayment of investment capital to the owner, begin by calculate what 40% of their paid in capital is to start with. You can find the amount of paid in capital in the month of January under Financial Activities on the Statement of Cash Flows or under Owners Equity on the Balance Sheet (unless part of it has been paid back previously). To record the 40% pay out, find Repayment of Paid in Capital under Financial Activities on the Statement of Cash Flows. You will record the 40% paid out amount as a negative number during the current month only on the Statement of Cash Flows. This entry will reduce the Cash at the Bank for the following month. If you run negative on cash then you are required to take a loan (see: Taking Loans). You also need to reflect the reduction of Owners Equity on the Balance Sheet on the Capital line. This entry records the fact that the company now owes the owner less than previous. It is important to note that SBA pre-approval is not a loan but merely pre-approval to get a loan sometime in the near future. Record the expense for this on the P&L under Other Expenses.

C12

How to use:

Your investment in your location is considered general maintenance or improvements. Depending upon what they are they could be considered an improvement to an asset but you do not own the property so you do not get credit for the expense as an increase in value to any asset that you own. You should negotiate with your landlord to reduce your rent to offset your expense however. Record the cost over the next three months as an addition to the Other Expense on the P&L. Remember to calculate your increase in contracts for the next three months. When calculating the increase, always round up in favor of your company. Here are some examples: If you currently have 12 contracts and you earn 10% then you would have 13.2 so you would round up to 14 and then the next month you would have 14 total contracts multiplied by 110% which equals 15.4 so you will round up to 16.

C13

How to use:

Industry associations can be a wonderful investment for your company. If you are active, you will meet many valuable new people, possible future team members, alias in the industry and you will learn a ton from people that have already been there. Record the expense under Other on the P&L. Don’t forget to draw a sales card and calculate the results before you finalize your income for the month.

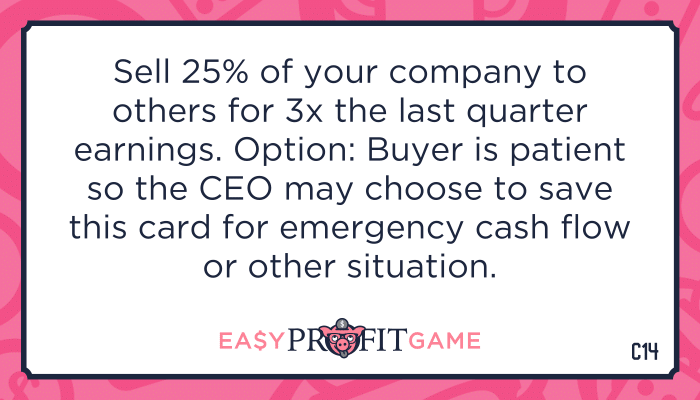

C14

How to use:

The CEO has the option to hold this card for sometime in the future when the company is worth more or when the company may be in greater need of cash… Remember, to consider the “winning” criteria of the game as you make your decision just as you would in your real life business. To properly account for the inbound revenue to the business, make these simple entries. But, before you do, note that the owner and investors have agreed to keep the investment capital in the company for future growth other than a partial refund of the original investment that the original owner will take. Start by making an entry to pay the original owner 25% of their original investment. This will be a reduction of the current Capital. As a result of this, you also need to go to the Statement of Cash Flows and make an entry in the Repayment of Paid in Capital under Financial Activities. Follow that by determining the total income for your last full quarter or the last three months (CEO’s choice). Multiply this sum by three. This accounts for the value of the 3x times income over that period. Next, increase the Capital under Owners Equity on the Balance Sheet equal to the amount the investor is injecting. Note that there are multiple owners now but the Balance Sheet does not care who owns the company. It is merely accounting for the state of the cash flows for the current month. So, this month, cash flows are going to look great because of the influx of cash. Now, because of the complexity of the calculation, follow these instructions closely. Determine the total income for your last full quarter or the last three months (CEO’s choice). Multiply this sum by three. This accounts for the value of the 3x times income over that period.

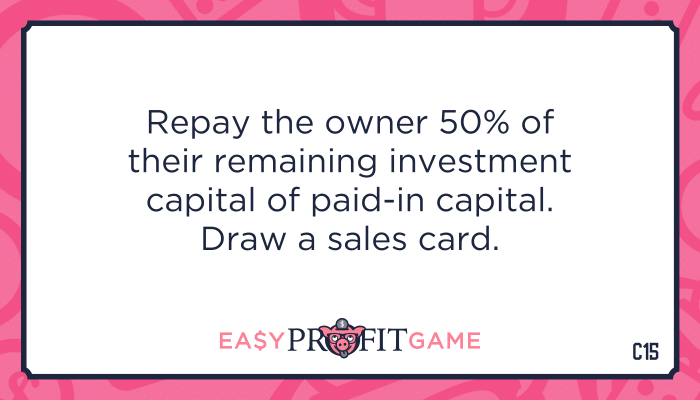

C15

How to use:

To calculated the repayment of investment capital to the owner, begin by calculate what 50% of their paid in capital is to start with. You can find the amount of paid in capital in the month of January under Financial Activities on the Statement of Cash Flows or under Owners Equity on the Balance Sheet (unless part of it has been paid back previously). To record the 50% pay out, find Repayment of Paid in Capital under Financial Activities on the Statement of Cash Flows. You will record the 50% paid out amount as a negative number during the current month only on the Statement of Cash Flows. This entry will reduce the Cash at the Bank for the following month. If you run negative on cash then you are required to take a loan (see: Taking Loans). You also need to reflect the reduction of Owners Equity on the Balance Sheet on the Capital line. This entry records the fact that the company now owes the owner less than previous. Don’t forget to draw a sales card and calculate the results before you finalize your income for the month.

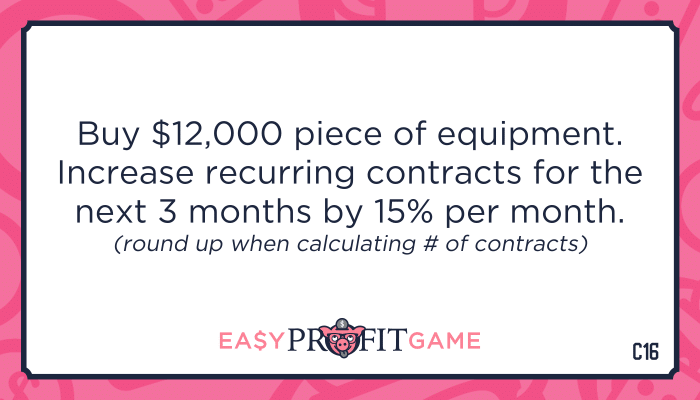

C16

How to use:

You are spending $12k but be careful not to make the mistake of recording this as an “Other Expense” on the P&L. Remember that you are purchasing equipment which is an asset that the company will then own so we need to record it differently than a common expense. Here is how you record it. You are going to make a positive entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking credit for the new asset that you just purchased. Next, you are going to make a negative entry on the Statement of Cash Flows under the Investment Activities section for Paid Out Purchase of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month. Remember to calculate your increase in contracts for the next three months. When calculating the increase, always round up in favor of your company. Here are some examples: If you currently have 10 contracts and you earn 15% then you would have 11.5 so you would round up to 12 and then the next month you would have 12 total contracts multiplied by 115% which equals 13.8 so you will round up to 14.

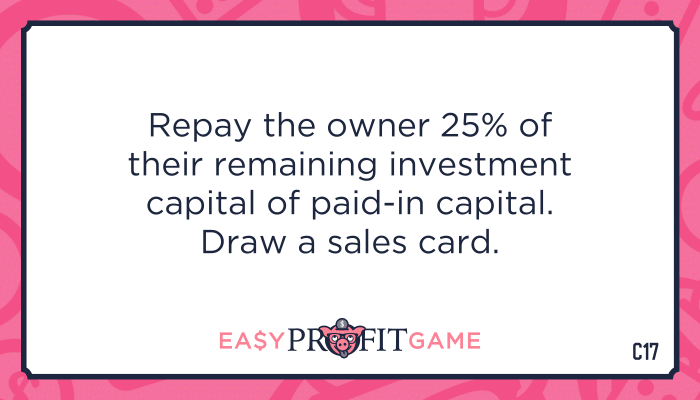

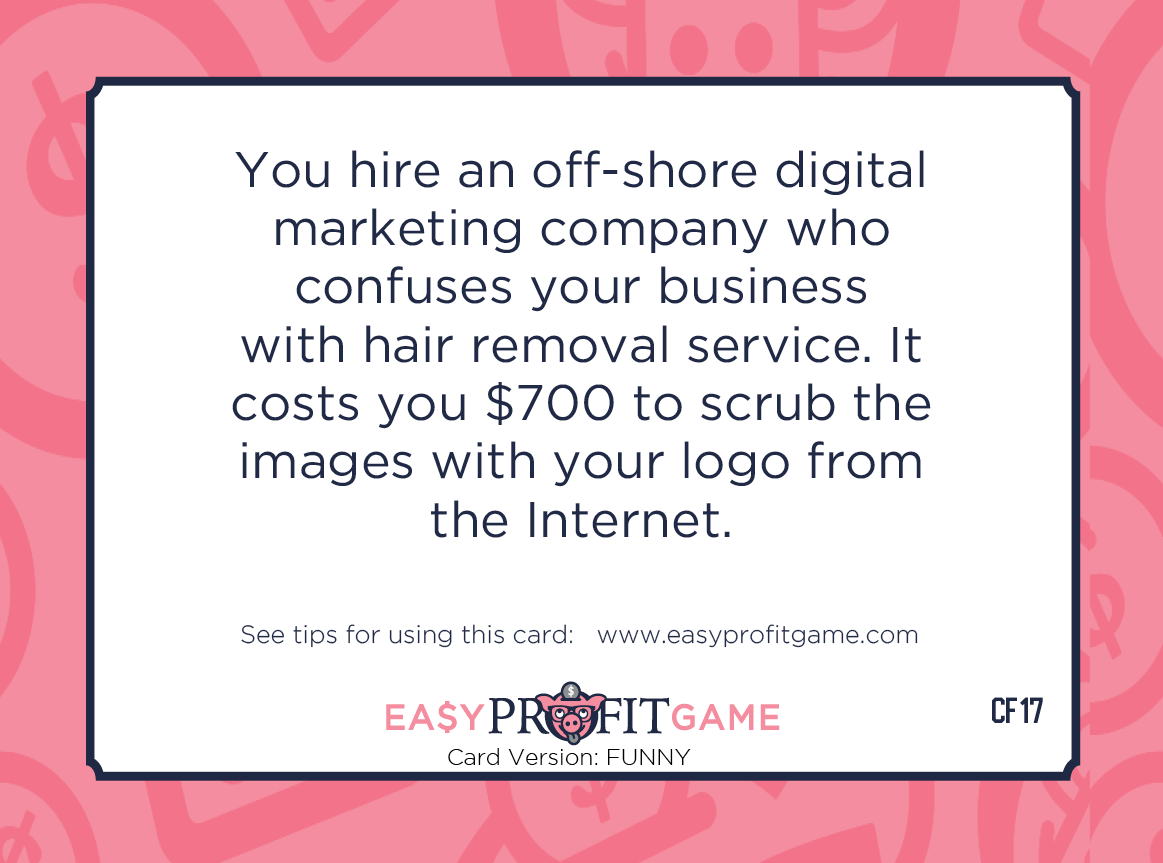

C17

How to use:

To calculated the repayment of investment capital to the owner, begin by calculate what 25% of their paid in capital is to start with. You can find the amount of paid in capital in the month of January under Financial Activities on the Statement of Cash Flows or under Owners Equity on the Balance Sheet (unless part of it has been paid back previously). To record the 25% pay out, find Repayment of Paid in Capital under Financial Activities on the Statement of Cash Flows. You will record the 25% paid out amount as a negative number during the current month only on the Statement of Cash Flows. This entry will reduce the Cash at the Bank for the following month. If you run negative on cash then you are required to take a loan (see: Taking Loans). You also need to reflect the reduction of Owners Equity on the Balance Sheet on the Capital line. This entry records the fact that the company now owes the owner less than previous. Don’t forget to draw a sales card and calculate the results before you finalize your income for the month.

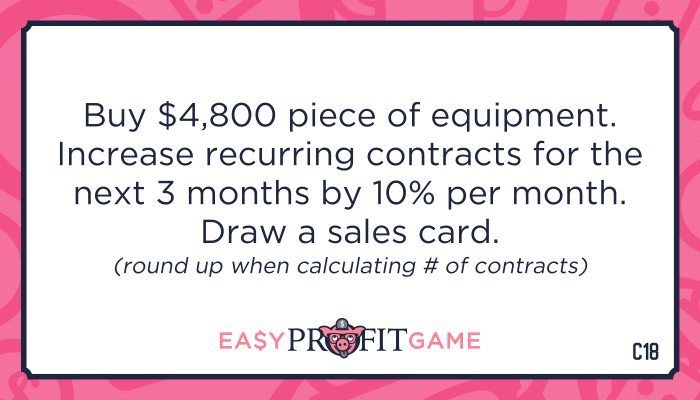

C18

How to use:

You are spending $4,800 but be careful not to make the mistake of recording this as an “Other Expense” on the P&L. Remember that you are purchasing equipment which is an asset that the company will then own so we need to record it differently than a common expense. Here is how you record it. You are going to make a positive entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking credit for the new asset that you just purchased. Next, you are going to make a negative entry on the Statement of Cash Flows under the Investment Activities section for Paid Out Purchase of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month. Remember to calculate your increase in contracts for the next three months. When calculating the increase, always round up in favor of your company. Here are some examples: If you currently have 12 contracts and you earn 10% then you would have 13.2 so you would round up to 14 and then the next month you would have 14 total contracts multiplied by 110% which equals 15.4 so you will round up to 16. Don’t forget to draw a sales card and calculate the results before you finalize your income for the month.

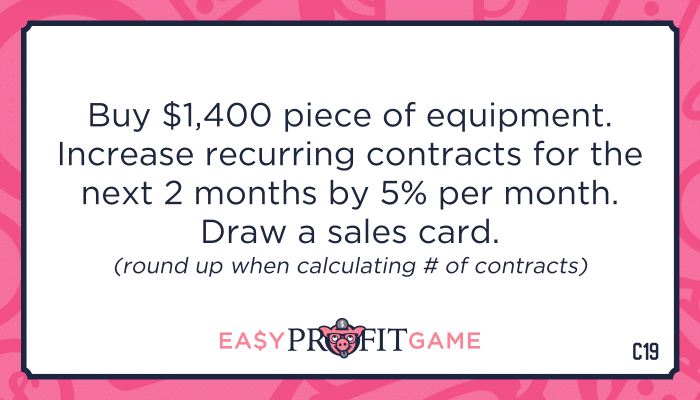

C19

How to use:

You are spending $1,400 but be careful not to make the mistake of recording this as an “Other Expense” on the P&L. Remember that you are purchasing equipment which is an asset that the company will then own so we need to record it differently than a common expense. Here is how you record it. You are going to make a positive entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking credit for the new asset that you just purchased. Next, you are going to make a negative entry on the Statement of Cash Flows under the Investment Activities section for Paid Out Purchase of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month. Remember to calculate your increase in contracts for the next two months. When calculating the increase, always round up in favor of your company. Here are some examples: If you currently have 10 contracts and you earn 5% then you would have 10.5 so you would round up to 11 and then the next month you would have 11 total contracts multiplied by 105% which equals 11.5 so you will round up to 12. Don’t forget to draw a sales card and calculate the results before you finalize your income for the month.

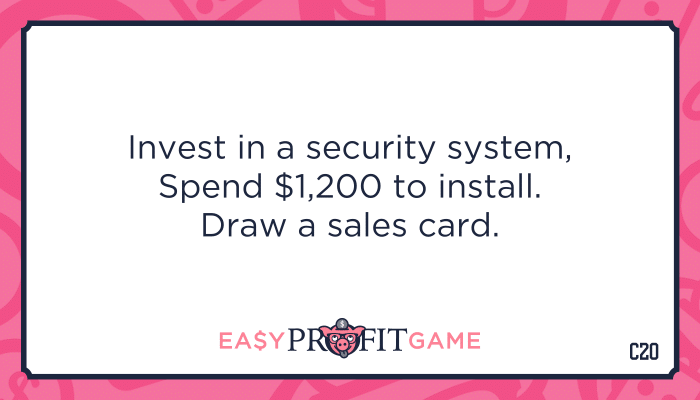

C20

How to use:

You are spending $1,200 but be careful not to make the mistake of recording this as an “Other Expense” on the P&L. Remember that you are purchasing equipment which is an asset that the company will then own so we need to record it differently than a common expense. Here is how you record it. You are going to make a positive entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking credit for the new asset that you just purchased. Next, you are going to make a negative entry on the Statement of Cash Flows under the Investment Activities section for Paid Out Purchase of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month. Don’t forget to draw a sales card and calculate the results before you finalize your income for the month.

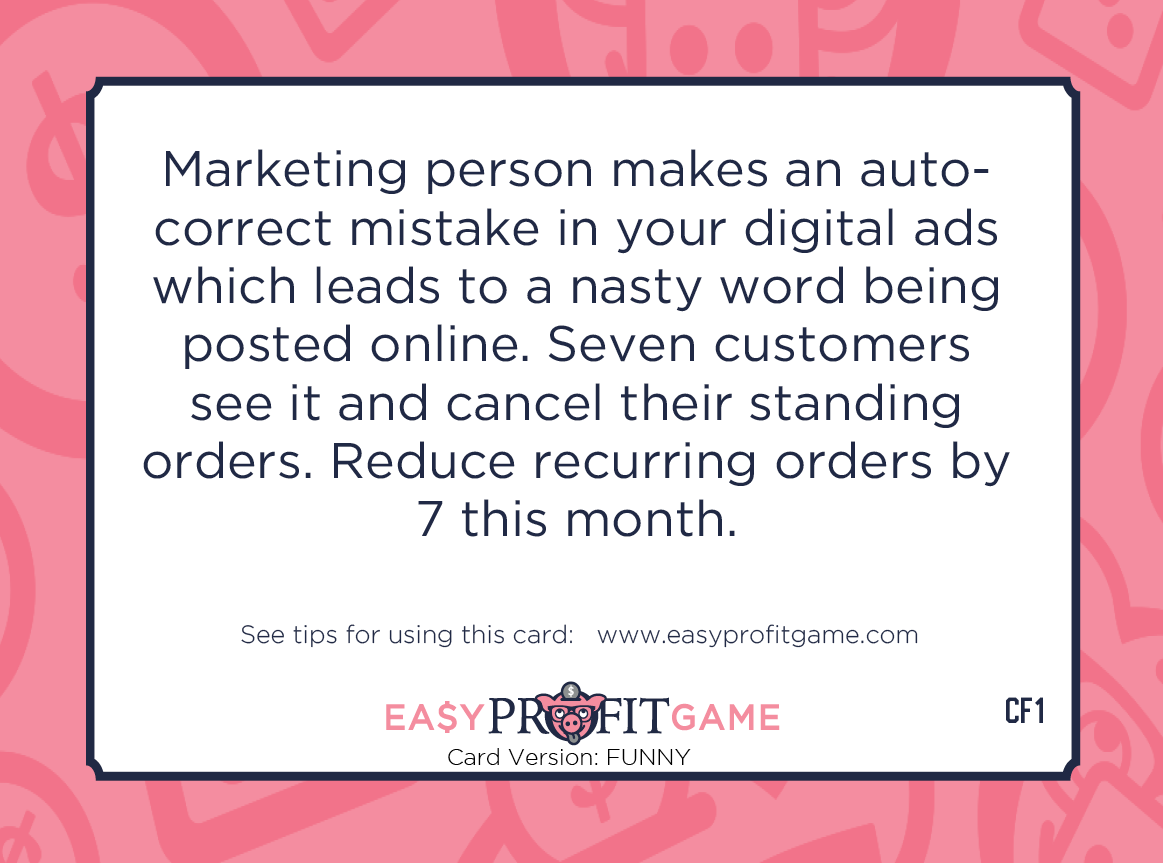

Funny Cards

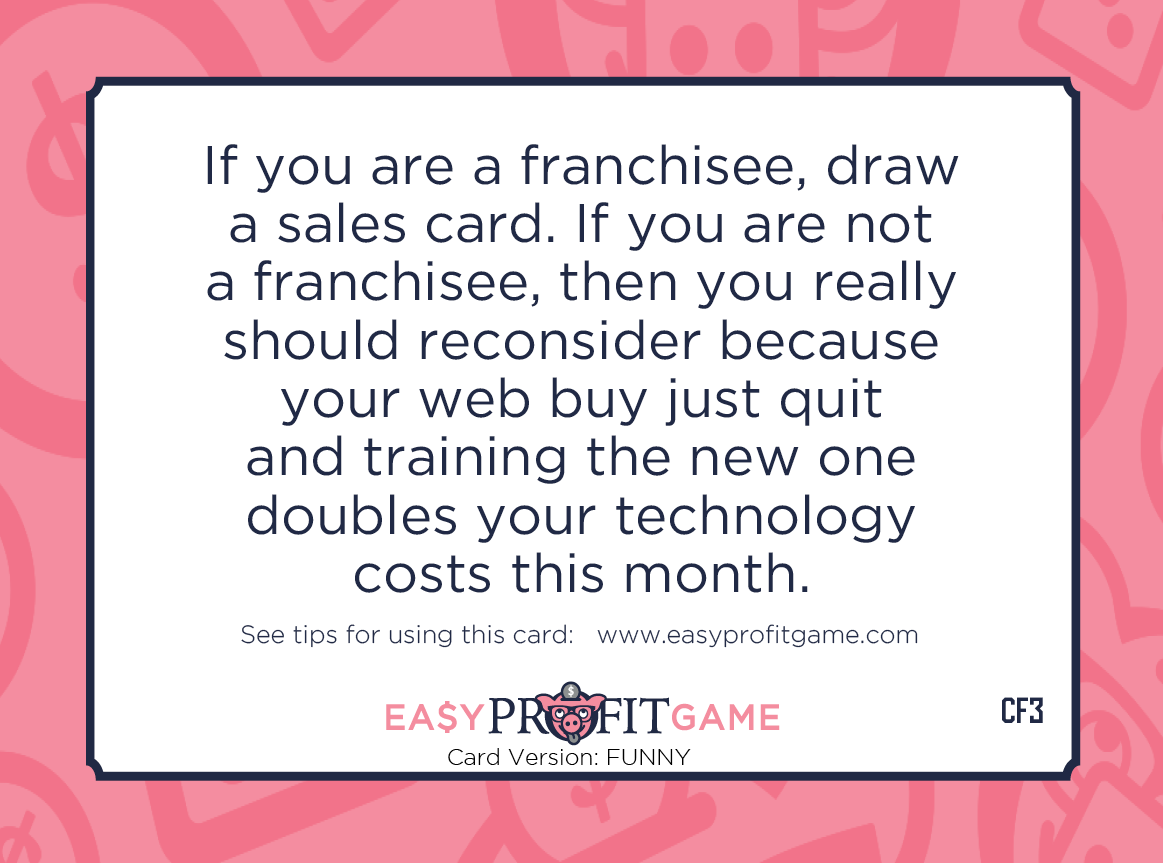

CF3

How to use:

Well, if you are a franchisee then you likely do not even see Technology Systems on your P&L because your franchisor has it on theirs! Congratulations. You may contribute to the technology fee but at least you do not have to deal with these kind of issues. If you are not a franchisee then your costs for Technology Systems expenses doubles on the P&L under expenses.

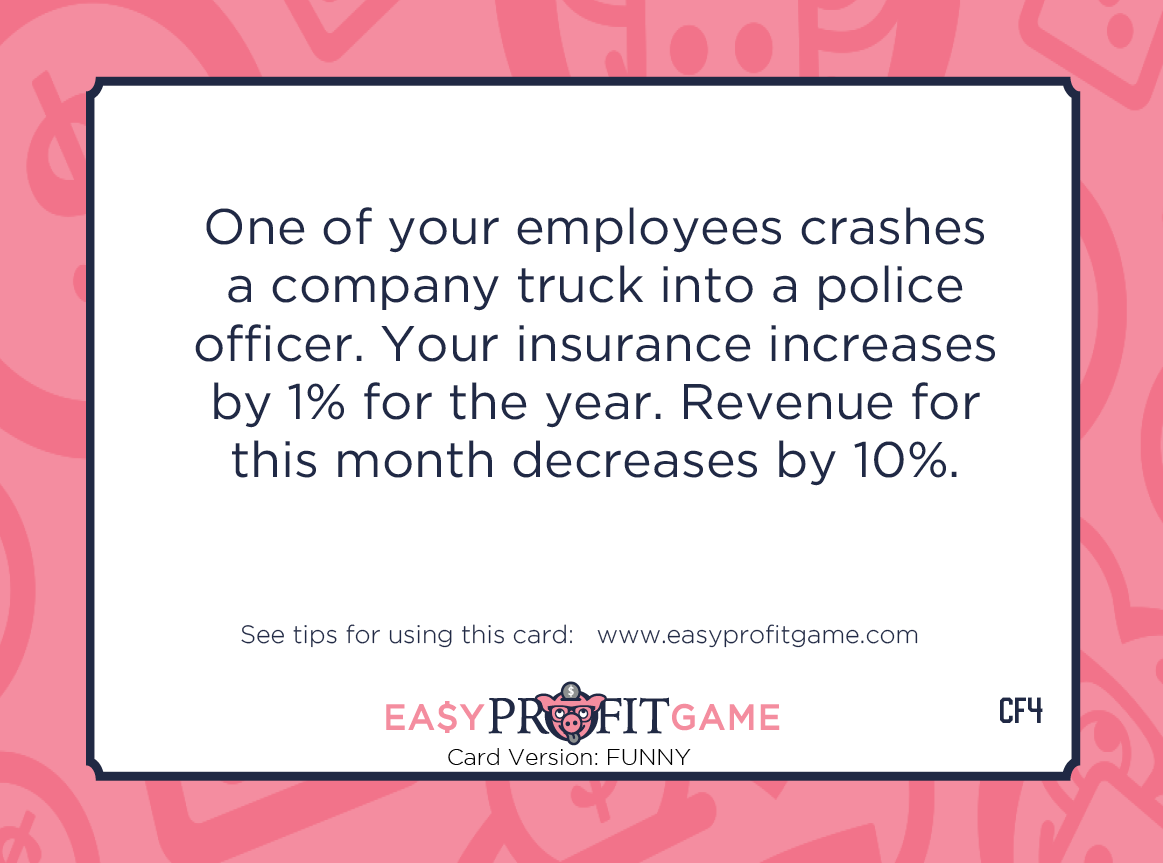

CF4

How to use:

Thankfully, your insurance covered the cost of the truck repairs but your insurance rates increase by 1% from what they are currently and that change sticks for future months so go ahead and cross out the 1% (or current) shown on the P&L and take it up by 1%. You also take a hit on your revenue by losing 1% for this month only. Record this as a negative number in the Other Revenue section so you will subtract this amount as you calculate the Total Income for the month.

CF6

How to use:

Ok, this sounds more complicated to record than it actually is. Let’s tackle the repayment of investment capital to the owner. Calculate what 25% of their paid in capital is to start with. You can find the amount of paid in capital in the month of January under Financial Activities on the Statement of Cash Flows or under Owners Equity on the Balance Sheet (unless part of it has been paid back previously). To record the 25% pay out, find Repayment of Paid in Capital under Financial Activities on the Statement of Cash Flows. You will record the 25% paid out amount as a negative number during the current month only on the Statement of Cash Flows. This entry will reduce the Cash at the Bank for the following month. You also need to reflect the reduction of Owners Equity on the Balance Sheet on the Capital line. This entry records the fact that the company now owes the owner less than previous. You are also spending $3,500 as an expense for computers so that will be recorded as an Other Expense on the P&L Finally, do not forget to draw a sales card before you complete your calculations for income this month.

CF8

How to use:

Easy mistake with self-check out and no bags because they charge for them. Maybe had you not been texting feverishly as you walked out of the store, you might have noticed that little part about not paying. Not a big deal in the end. It clearly was not intentional. Record the expense under Materials on the P&L.

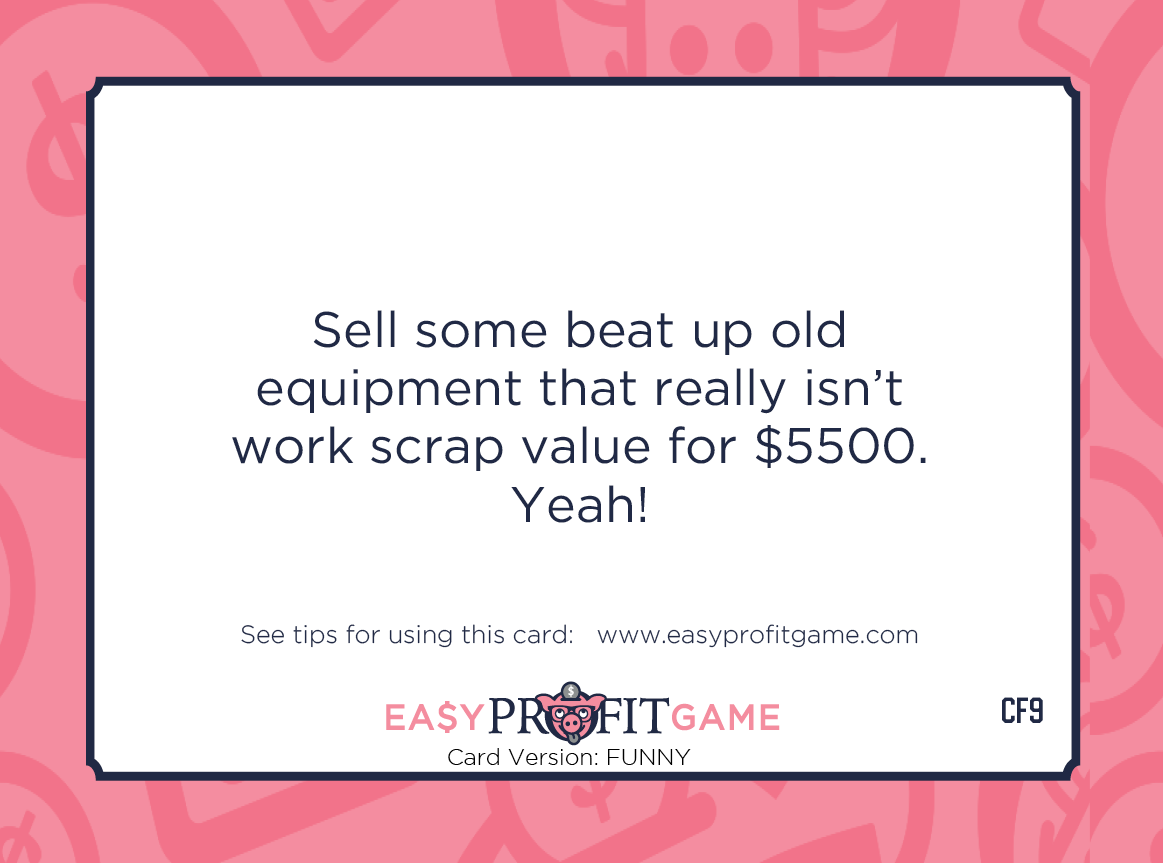

CF9

How to use:

You are selling $5,500 worth of old equipment but be careful not to make the mistake of recording this as Income on the P&L. Remember that you are selling equipment which is an asset that the company so you need to enter that differently than general income. Here is how you record it. You are going to make a negative entry on the Balance Sheet under Equipment & Real Estate. By doing so, you are taking voiding the value of the past asset that you no longer own. Next, you are going to make a positive entry on the Statement of Cash Flows under the Investment Activities section for Paid In Sale of Equipment or Property. This entry will flow down to the Net Cash Flow for the month and will then affect the Cash at the Bank for the next month.

CF11

How to use:

To calculated the repayment of investment capital to the owner, begin by calculate what 40% of their paid in capital is to start with. You can find the amount of paid in capital in the month of January under Financial Activities on the Statement of Cash Flows or under Owners Equity on the Balance Sheet (unless part of it has been paid back previously). To record the 40% pay out, find Repayment of Paid in Capital under Financial Activities on the Statement of Cash Flows. You will record the 40% paid out amount as a negative number during the current month only on the Statement of Cash Flows. This entry will reduce the Cash at the Bank for the following month. If you run negative on cash then you are required to take a loan (see: Taking Loans). You also need to reflect the reduction of Owners Equity on the Balance Sheet on the Capital line. This entry records the fact that the company now owes the owner less than previous. It is important to note that SBA pre-approval is not a loan but merely pre-approval to get a loan sometime in the near future. Record the expense for this on the P&L under Other Expenses.

CF12

How to use:

Hey! What is wrong with the ghetto. What a selfish and racist move! Shame on you. Increase your Rent expense the next three months and increase your recurring contracts by 10% per month for the next three months. Sales continue to be positive after that because customers are not scared to visit. Smart move afterall regardless of the faux news.

CF13

How to use:

Ok, if the pizza was actually good, this may not really be a horrible circumstance. Who doesn't enjoy a little too much good pizza! Record the expense under Other on the P&L. Save the recipe in case you get a prick IRS inspector that wants to know why you ordered four pizzas per staff member and recorded it as a company expense.

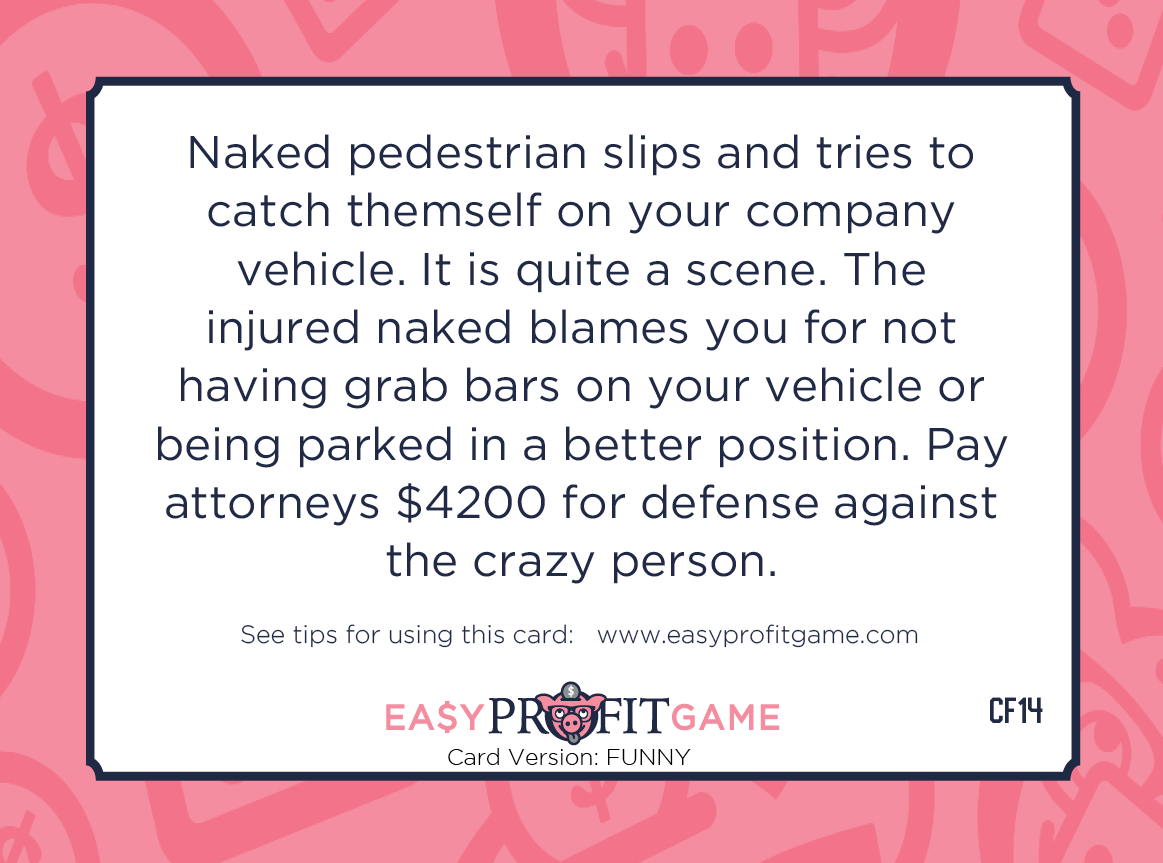

CF15

How to use:

That actually wasn't too bad for a fancy vegan wedding cake. Speaking of that, what would a plant-based cake actually be made of? Record the expense under Other on the P&L. Send a personal note to the bride & groom thanking them for the wonderful staff party and consoling them for their loss of memories and would-have-been reception images.

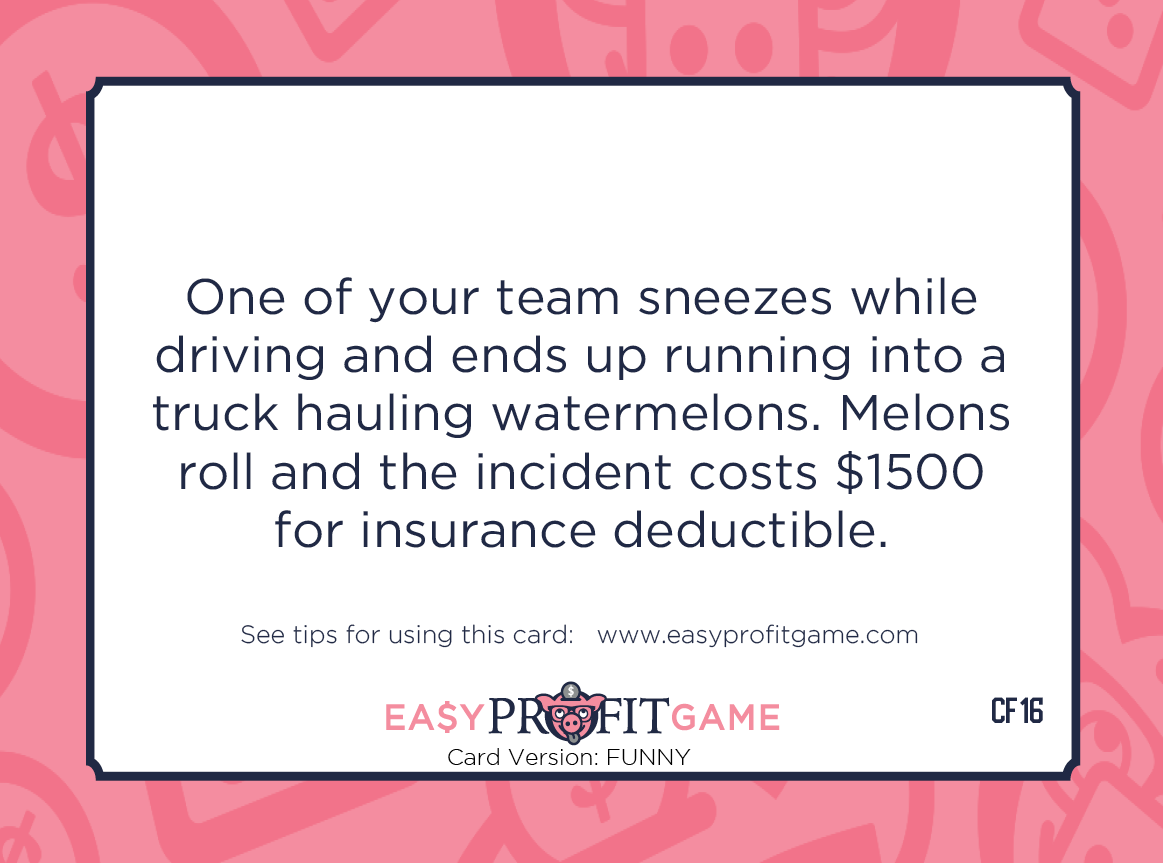

CF16

How to use:

Thankfully the truck crashed next to a busy playfield which stopped the soccer game and everyone enjoyed fresh watermelon. You decide not to fire the driver since it was one of your kids and they used their pocket knife to cut up watermelon for everyone and also handed out sticky business cards. Record the expense under Insurance on the P&L for this month.

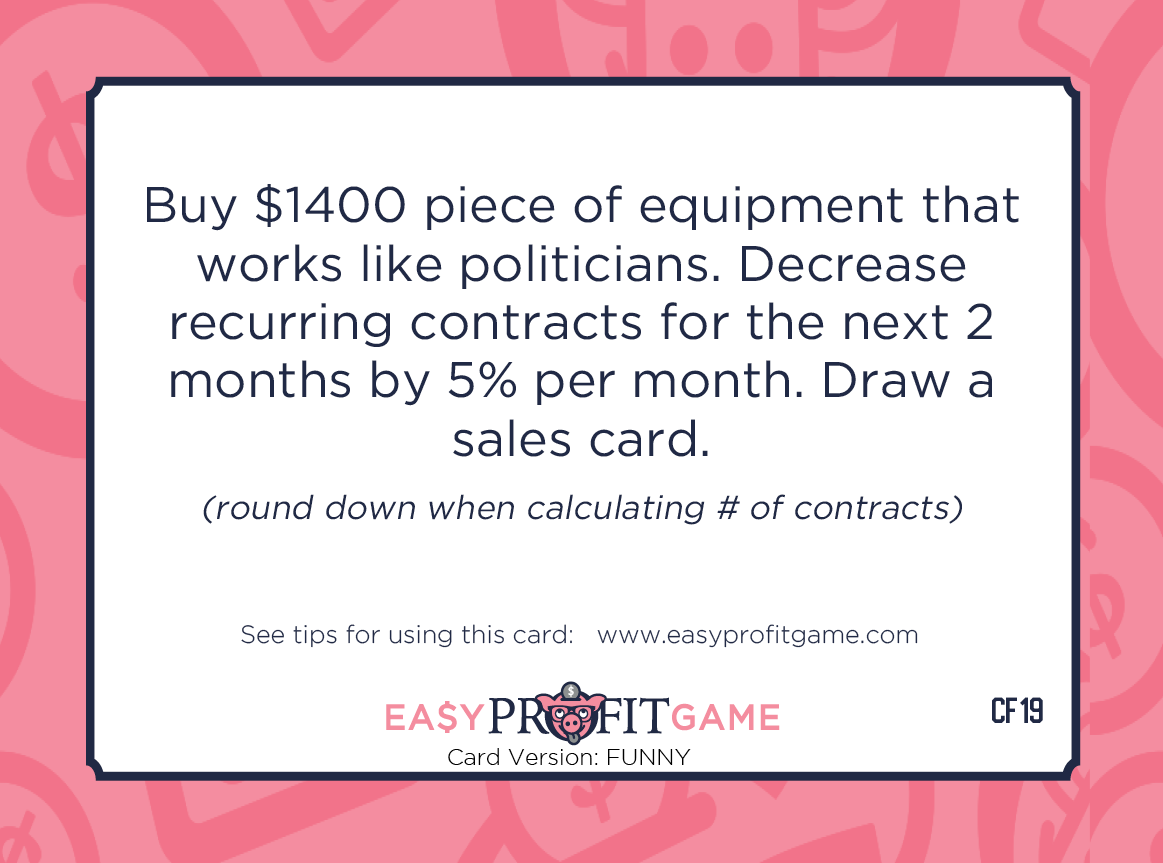

CF19

How to use:

Wouldn't it be nice if we could capitalize politics. O wait! Some of them have and it is called corruption! Record the $1400 under Other expenses on the P&L. Then, decrease recurring contracts by 5% on the P&L for the next two months. Make this calculation after any gains or additions that you make for those months like when you draw a sales card and win big!